Avoid paying too much tax!

For medical professionals relocating to Australia for work, there are some important factors to be aware of in order to avoid paying more tax than you should.

Public health professionals are entitled to tax concessions that will save you thousands of dollars each year. These concessions aren’t provided automatically but can be accessed through what’s called ‘salary packaging’.

What is Salary Packaging?

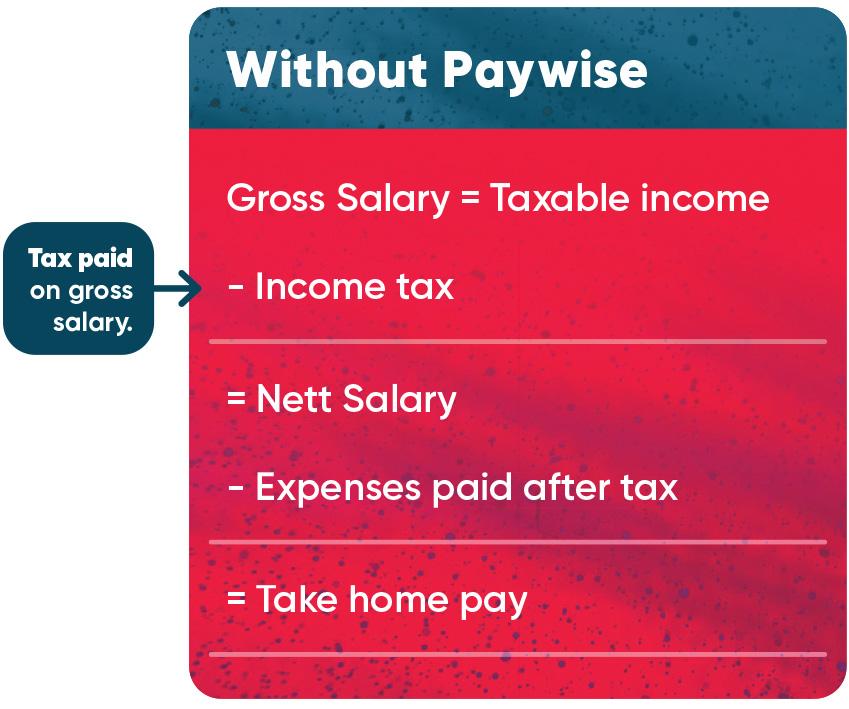

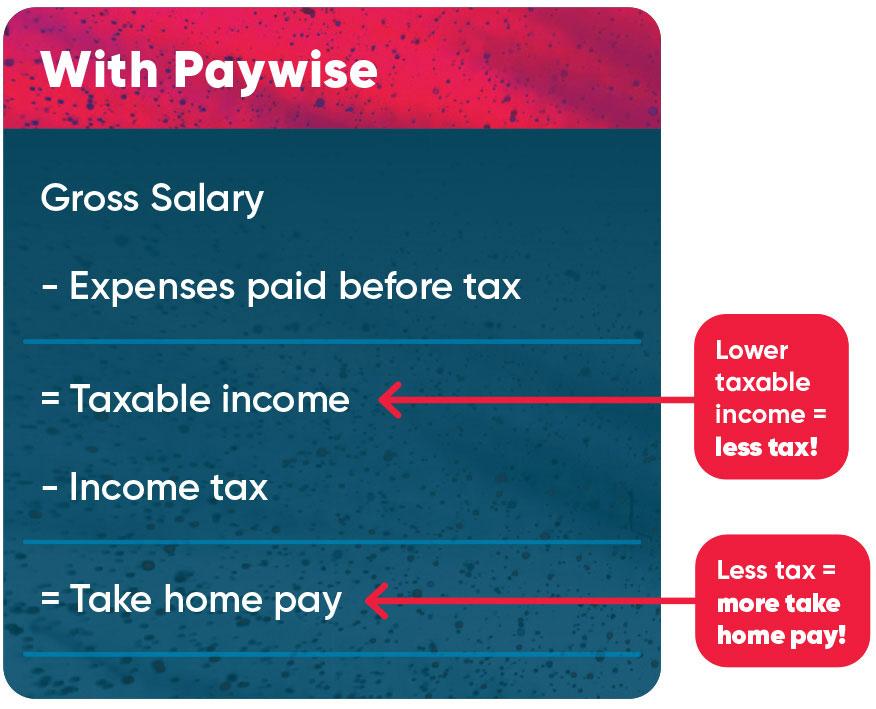

Salary packaging is a simple way of using your pre-tax salary to pay for certain expenses before your income is taxed. This reduces your taxable income, meaning you pay less tax and get more in your pocket!

Here’s how your pay is calculated without salary packaging, and how it’s calculated with salary packaging set up:

What items can I salary package?

As a public health employee, you are fortunate enough to be able to salary package a range of items (or ‘benefits’), all helping you increase your take-home pay by paying less tax. Each year up to $9,010 can be packaged for rent and general living expenses and a further $2,650 for dining out. These amounts are known as the benefit ‘caps’.

There is a range of other benefits that may be available to you, including the potential to salary package your car. Plus, as a health professional moving to Australia, you may even be able to salary package your relocation costs! Speak to a Paywise representative to find out how.

How do I arrange Salary Packaging?

That’s where we come in! Paywise has been in salary packaging since 1989 and we take care of the complex stuff for you. We liaise with your employer to take funds from your pre-tax salary and these funds then go towards your chosen ‘benefit(s)’.

For example, you might choose to have your rent paid with your pre-tax income via salary packaging. We take the amount from your pre-tax pay (so you pay less tax), then either pay it directly to your landlord or deposit the funds into your bank account.

For Living Expenses we offer the industry-leading Paywise card! The way this works is simple – the pre-tax funds taken from your salary are deposited into your Paywise account and are available for you to spend via your Paywise card. You can make payments directly to merchants from your card as you would with any other credit or debit card. The card can be added to your Google or Apple digital wallet or is also available in plastic.

Alternatively you can pay for items from your post-tax pay and seek reimbursement, but using the Paywise card make your life a lot easier!

The Paywise card is also available for the dining out via the ‘Meal Entertainment’ benefit. You don’t need to do anything differently when you make the transaction – based on who the merchant is, it is automatically allocated to either Living Expenses or Meal Entertainment.

The Paywise App allows you to see all your incoming and outgoing transactions, check your account balance, lodge any reimbursement claims, update your bank account details, access your digital cards and chat to our Customer Experience team.

Where do I start?

The best place to start is to contact your employee benefits consultant.

Depending on who your employer is, we have a dedicated salary packaging expert on hand to answer any questions you have, and get you set up to start saving straight away!

Grant Huisman.

If you work for North Metro, Health Support Services, Pathwest, WA Country Health Service – Head Office, Southwest or Great Southern click to contact Grant Huisman below.

Judi Gardner.

If you work for South Metro, Pathwest or Child and Adolescent health service, click to contact Judi Gardner below.

Sherri Smith.

If you work for East Metro, Pathwest, WA Country Health Service – Goldfields, Wheatbelt, Pilbara, Kimberley or Midwest click to contact Sherri Smith below.

So don’t pay more tax than you need to, start salary packaging with Paywise, today!