Salary Packaging:

Novated Leasing:

Salary Packaging.

You can easily update your bank details via the Paywise App or our Member Portal. Visit our Update your bank details to learn how.

Certain personal details can be changed via the Paywise Member Portal. To update your residential address, email address or payroll details please contact our Customer Experience team on 1300 132 532 or by emailing customerexperience@paywise.com.au.

Lodging your reimbursement claim via the Paywise App or Member Portal is quick and easy and you don’t need to complete any forms. Simply upload your claim documents and follow the steps.

Try lodging your claim via the Member Portal or Paywise App – it is quick and easy and you do not need to complete any forms. More information is available here. Otherwise you can email your completed claim form and documents to reimbursments@paywise.com.au.

Partial payments are usually due to a Living Expenses reimbursement claim ending. Log into the Member Portal to check your claims and lodge a new claim. Once a new reimbursement claim has been received your payment will be made within 48 business hours. The other cause may be due to your annual cap of $9,010 or $15,900 being exhausted for the FBT year. If this is the case no further payments will be made until the new FBT year.

The caps show what is available to you as part of your employer’s arrangements with Paywise even if you are not utilising them. For more information, please contact the Customer Experience team to find out more about what entitlements are available to you.

Please contact Paywise on info@paywise.com.au or 1300 132 532 to discuss the establishment of a new benefit.

If you are a casual employee, you are likely to have nominate a percentage of your gross wage to be deducted towards your Paywise salary packaging. This will ensure an amount is received from your gross wage regardless of the hours worked. You can request to amend your percentage at any time to ensure the amount we receive is right for you. Simply complete this form and one of our Customer Experience Consultants will review your request and confirm with you once actioned.

Yes! If you have a HECS/HELP debt, access government benefits, pay or receive child support, you may still benefit from Salary packaging. Find out more here.

Salary Packaging is not only for full-time employees. If you work casual hours or part-time and your employer allows you to participate in salary packaging Paywise is here to help. If you are earning under the tax-free threshold of $18,200 you may no longer be required to pay income tax or the Medicare levy therefore this could affect your ability to salary package and independent financial advice is recommended.

If you would like to adjust the amount you are salary packaging, please complete this online form.

We pride ourselves on offering competitively priced membership fees which entitle you to cost-effective salary packaging solutions along with our high standards of customer service and your FBT year end reporting. We cannot advertise our membership fees as these vary by employer and the terms of our agreements with each employer prohibit us from being able to disclose these fees publicly. To find out the fees applicable under your employer please speak to your Paywise Employee Benefits Consultant or Contact Us.

Fees are also payable for our Living Expenses and Meal Entertainment card, which are associated with the administration of the card, which is available as a digital card in your Google or Apple Pay wallet or in plastic. Not only does it provide convenience for making transactions but also negates the need to submit reimbursement claims for each transaction to satisfy ATO requirements. Again, these costs vary for each employer so please speak to your Paywise Employee Benefits Consultant or Contact Us.

Nominal one-off fees also apply to ad hoc benefits such as portable electronic devices, airline lounge membership and relocation expenses, financial advice, professional members fees and self-education expenses.

Additional charges apply for novated leases. Please Contact Us for further information.

If you are changing employers, whether you are moving to an employer that Paywise provides salary packaging services for, or you’re currently with Paywise and need to switch to your new employer’s provider, we can assist you with the transition process. To start the process, visit our changing employer page.

Paywise and your employer highly recommend seeking independent financial advice in relation to the impact salary packaging will have for you. In most cases you can salary package the cost of the financial advice or claim back in your income tax return. Paywise is not licensed to provide you with financial advice.

Capped benefits are fringe benefits that employees of certain employers are entitled to receive, up to a specific threshold (or ‘cap’) without incurring Fringe Benefits Tax (FBT). These ‘cap’ amounts are determined by the ATO and vary depending on the type of employer. For items such as mortgage, rent and living expenses, employees of eligible charities can salary package up to $15,900 per annum, and employees of public hospitals up to $9,010. Some employees are also entitled to salary package up to $2,650 for Meal Entertainment expenses.

Those who work for ‘Rebateable’ employers such as independent schools are not exempt from FBT but are entitled to a 47% rebate on FBT, capped at $15,900 of salary packaged benefits each year.

More about capped benefits is available here.

‘Outside of the cap’, ‘above the cap’ or ‘uncapped’ benefits include novated leasing of a car, portable electronic devices (primarily used for work), self-education expenses or additional superannuation payments and more. These do not fall under the ‘cap’ or incur FBT, and don’t have a limit.

More about uncapped benefits is available here.

For FAQs relation to a Paywise Card please see our Paywise Card page.

Novated Leasing.

A Paywise Novated Lease is a type of salary packaging benefit which enables your employer to make payments from your salary to cover running costs and the finance for your vehicle. These payments are made at a set agreed rate over the period of your choice (you can choose between 1 & 5 years). The way your benefit is made up is by splitting your payment full payment (which includes all your fuel, maintenance & service, tyres & insurance) between a pre and post-tax salary contribution; this is where the salary packaging happens.

Salary packaging a vehicle with Paywise enables you to receive significant tax savings and discounts. Some of these include reduced purchase price of your vehicle (commonly known as fleet pricing), tax and GST savings on the purchase price of your vehicle and the running costs.

No, a Paywise Novated Lease will benefit most employees who earn a huge range of incomes. Paywise tailor your lease based on your salary, km’s driven, lease term and the car you would like to package, we do it all for you.

No, you do not need to use the vehicle for business related travel with a Paywise lease.

Paywise gives you four simple choices at the end of your lease:

- 1. Paywise Members often transition smoothly to a new vehicle with minimal changes in their regular payments. The sale of the existing car usually adequately covers the residual balance owing.

- 2. If you’re happy with your current vehicle, you may be able to refinance the residual value and continue to enjoy the convenience and tax savings.

- 3. You can pay out the residual (commonly referred to as the balloon) at the end and then own the vehicle.

- 4. Sell back your vehicle – we’ll get you the best price on your car from our Australia-wide network of wholesale partners.

Paywise will contact you towards the end of your lease to work closely with you to ensure you make the best decision. More information and contact details are here.

Most larger employers offer salary packaging, and leases can be transferred to a new employer and packaging provider. If you do start interviewing for another job, it’s worth checking that any potential employer offers novated leasing as a staff benefit. Paywise would assist in providing all the relevant information necessary to help in the move should this happen during the lease. If the new employer does not offer packaging for novated leases, or you decide not to work for a few months, then you could take over the monthly lease payment to the financier from your own bank account via direct debit and pay for all the running costs form your own post-tax income.

If you are changing employers, whether you are moving to an employer that Paywise provides salary packaging services for, or you’re currently with Paywise and need to switch to your new employer’s provider, we can assist you with the transition process. To start the process, visit our changing employer page.

You can salary package a vehicle for your immediate family. This means that you can package a car for anyone in the immediate family such as partners or your children.

Under a Novated Lease, the financier requires “clear title” on the car being leased. This means they pay the drive away price on the dealer invoice on settlement, with any agreed value for a trade in being paid back to you by the dealership on the changeover of the two cars. This isn’t a bad thing as it means the (tax-free) money you receive from your trade-in can be put to better use, either by investing the funds or paying down other interest incurring liabilities, rather than tying up post tax money in a depreciating asset such as a car.

Your novated lease operates by having deductions made from your salary to cover the budgeted costs of financing and running your car. While some budgeted costs are fixed and therefore known in advance, others are conservative estimates based on a number of variable factors including kilometres driven and the price of fuel.

Your salary deductions do not commence immediately upon settlement of your lease. Therefore, to avoid any FBT liability and to ensure required funds are collected to cover all obligations of the lease, adjustments may be made to your salary deductions within the first FBT Year (1 April – 31 March) of your lease. The amount of these adjustments (or ‘catch up payments’) will vary depending on the time lag between settlement and your first salary deduction, the number of pay periods remaining in the current FBT Year and the amount of each lease payment. Speak to your leasing consultant for more information.

If you are travelling more than initially anticipated, it is likely that your fuel costs will be higher than budgeted. It can also increase your servicing and tyres costs. In order to allow for additional expenditure, a budget adjustment will need to be made by increasing the deductions that are made from your salary. To request an adjustment to your budget please complete this form.

Your spendable balance is different to the overall balance shown in your account. We protect funds for your monthly finance payment and Paywise insurance premium (where appropriate) and subtract these amounts from your overall balance to calculate your ‘spendable balance’, available for costs such as fuel, servicing, tyres and registration. If your spendable balance is low, you my require an adjustment to be made to your budget. You can request a budget adjustment here.

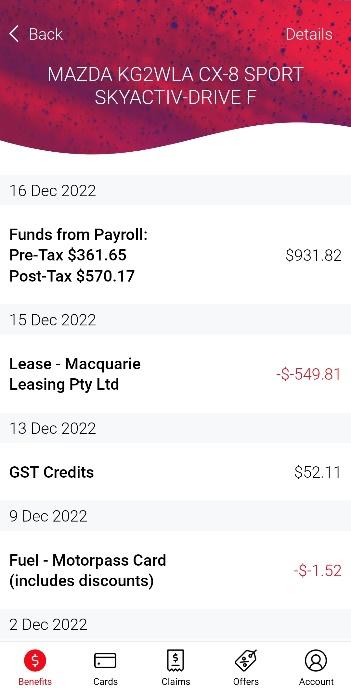

You can see your total budget amount and total spent amount and a breakdown of these amounts in the Paywise App and Member Portal.

In the Paywise App, go to ‘Benefits’ in the footer menu and select your Novated Lease. Then choose the ‘Details’ option in the top-right.

|

|

In the Member Portal, login and then choose your Novated Lease benefit from the home screen. At the top you will see your Total Budget Amount and Total Spent Amount, and tap ‘Details’ to reveal a breakdown of these amounts.

It is important that your account maintains funds to cover upcoming costs. If your expenditure has exceeded the budgeted amount, we may ask you to increase your budget to maintain sufficient funds in your account. Not having sufficient funds in your novated lease account to meet your finance repayment obligations will result in missed payments and arrears to the financier, potentially impacting your credit profile. This would also impact on our ability to make reimbursements to you for vehicle expenses.

After all costs have been incurred, any excess funds in your account can be transferred to another eligible salary packaging benefit or can be returned to you via your employer’s payroll service and will be subject to income tax.

Two options exist for such payments:

1. Pay the amount yourself and lodge a reimbursement claim: Use the ‘Claims’ option via the Paywise App or Member Portal and choose to have the funds deposited to your reimbursement bank account.

2. Make the payment directly from your Paywise account: Use the ‘Claims’ option via the Paywise App or Member Portal and choose BPAY.

Servicing and tyres can be paid for and claimed as above. Alternatively, you may also be able to pay for such costs using your Paywise Fuel Card, however please note the default transaction limit of $800 that applies to Paywise Fuel cards. To increase your limit please contact us.

All payments are dependent on sufficient funds being available in your novated lease account and it is highly recommended that you check your balance at the time of submitting your payment request. If insufficient funds are available, this may delay your payment being processed.

While this is possible, it negates some of the key benefits of a novated lease: paying for expenses with pre-tax salary; receiving credits for GST on car-related expenses; and receiving fuel discounts via the Paywise Fuel Card.

If you are covered under the Paywise comprehensive motor vehicle insurance policy, please click here for important information including how to make a claim.

Fuel Card

Visit https://www.paywise.com.au/motorpass/ to learn more about your fuel card and find out where you can use it. We recommend checking before you use your card. Remember to advise Paywise 48 hours prior to large purchases ($800 and above) such as tyres and servicing.

If your transaction exceeds your daily or weekly transaction limit it will decline. Please contact Paywise 48 hours prior to all works that will cost $800 or more, to increase your transaction limit. You can call us on 1300 132 532.

If you require your limit increased, please fill out the form here.